Can We Claim Gst Input On Stationery . input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. can educational institutions claim gst input credit on stationery? For a taxpayer, it is essential to. Educational institutions can claim input. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed.

from www.youtube.com

For a taxpayer, it is essential to. 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. can educational institutions claim gst input credit on stationery? Educational institutions can claim input. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed.

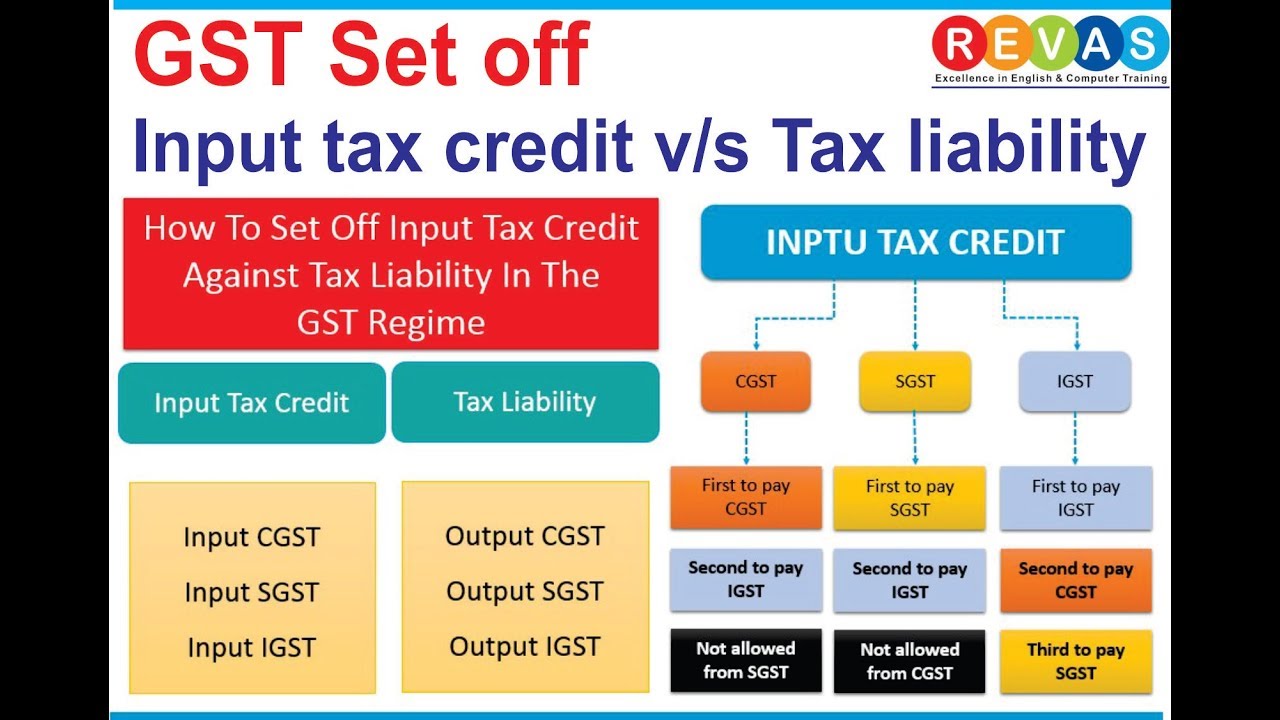

How to GST SET OFF Input Tax & Output Tax CGST, SGST, IGST part1 YouTube

Can We Claim Gst Input On Stationery can educational institutions claim gst input credit on stationery? Educational institutions can claim input. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. For a taxpayer, it is essential to. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. can educational institutions claim gst input credit on stationery? 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used.

From cleartax.in

GST input tax credit on supply of Goods or Services Can We Claim Gst Input On Stationery can educational institutions claim gst input credit on stationery? 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. Educational institutions can claim input. itc can. Can We Claim Gst Input On Stationery.

From itp.com.au

How do you claim GST credits on your BAS The Tax Professionals Can We Claim Gst Input On Stationery For a taxpayer, it is essential to. 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. can educational institutions claim gst input credit on stationery? input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. . Can We Claim Gst Input On Stationery.

From exodyxucw.blob.core.windows.net

Can We Take Gst Input On Construction at Alicia Holley blog Can We Claim Gst Input On Stationery input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. 22 rows have a look on goods and services that are not eligible to claim (itc) input. Can We Claim Gst Input On Stationery.

From dxofdppjh.blob.core.windows.net

Can You Claim Back Gst On Commercial Property at James Gonzalez blog Can We Claim Gst Input On Stationery input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. 22 rows have a look on goods and services that are not eligible to claim. Can We Claim Gst Input On Stationery.

From exodyxucw.blob.core.windows.net

Can We Take Gst Input On Construction at Alicia Holley blog Can We Claim Gst Input On Stationery can educational institutions claim gst input credit on stationery? though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. For a taxpayer, it is essential to. Educational institutions can claim input. itc can be claimed by a person registered under gst only if he fulfils all. Can We Claim Gst Input On Stationery.

From www.youtube.com

GST BIG UPDATEGST INPUT TAX CREDIT CLAIM MADE EASYGST INPUT TAX Can We Claim Gst Input On Stationery input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. input itc can be reduced from the gst payable on the sales by the taxable. Can We Claim Gst Input On Stationery.

From www.youtube.com

How can you claim input tax credit to save on GST A must watch for Can We Claim Gst Input On Stationery input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. 22 rows have a look on goods and services that are not eligible to claim (itc) input. Can We Claim Gst Input On Stationery.

From gstserver.com

Can we claim GST input on Car Insurance? GST Compliance Updates Can We Claim Gst Input On Stationery though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. 22 rows have a look on goods and services that are not eligible to claim (itc) input. Can We Claim Gst Input On Stationery.

From www.youtube.com

How to GST SET OFF Input Tax & Output Tax CGST, SGST, IGST part1 YouTube Can We Claim Gst Input On Stationery 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Educational institutions can claim input. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. can educational institutions claim gst input credit on stationery? itc can. Can We Claim Gst Input On Stationery.

From carajput.com

COMPLETE UNDERSTANDING ON INPUT TAX CREDIT UNDER GST Can We Claim Gst Input On Stationery Educational institutions can claim input. can educational institutions claim gst input credit on stationery? 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. though input. Can We Claim Gst Input On Stationery.

From www.youtube.com

how to claim gst input tax credit on amazon Get gst input tax credit Can We Claim Gst Input On Stationery 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. Educational institutions can claim input. though input tax credit can be claimed by a person registered under. Can We Claim Gst Input On Stationery.

From exceldatapro.com

Download Revised GST Input Output Tax Report in Excel ExcelDataPro Can We Claim Gst Input On Stationery input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. For a taxpayer, it is essential to. itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. though input tax credit can be claimed by a person. Can We Claim Gst Input On Stationery.

From www.youtube.com

GST Input Credit Adjustment Excel Part2 GST Tutorial GST Practical Can We Claim Gst Input On Stationery itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. Educational institutions can claim input. input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. can educational institutions claim gst input credit on stationery? though input. Can We Claim Gst Input On Stationery.

From cleartax.in

What is Input Credit under GST ? And how to claim it? Can We Claim Gst Input On Stationery For a taxpayer, it is essential to. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. input itc can be reduced from the gst payable on. Can We Claim Gst Input On Stationery.

From okcredit.in

GST Advantages With Examples. Here are some important points for you Can We Claim Gst Input On Stationery can educational institutions claim gst input credit on stationery? itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. input tax credit (itc) of the taxes. Can We Claim Gst Input On Stationery.

From instafiling.com

How to claim ITC in GST (Ultimate Guide) Can We Claim Gst Input On Stationery itc can be claimed by a person registered under gst only if he fulfils all the conditions as prescribed. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. 22 rows have a look on goods and services that are not eligible to claim (itc) input. Can We Claim Gst Input On Stationery.

From www.youtube.com

How to Claim gst input credit (ITC) in Catpro Software according to Can We Claim Gst Input On Stationery For a taxpayer, it is essential to. though input tax credit can be claimed by a person registered under gst for most inputs, some types of goods and. input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. input tax credit (itc) of the taxes paid. Can We Claim Gst Input On Stationery.

From blog-pretaxessolutions.blogspot.com

How to Claim GST Input Tax Credit A Comprehensive Guide Can We Claim Gst Input On Stationery 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. For a taxpayer, it is essential to. can educational institutions claim gst input credit on stationery? input itc can be reduced from the gst payable on the sales by the taxable person only after fulfilling some conditions. . Can We Claim Gst Input On Stationery.